In the digital age, where screens have become the dominant feature of our lives but the value of tangible printed objects isn't diminished. Be it for educational use as well as creative projects or just adding an element of personalization to your area, Debt Snowball Tips are now a useful source. The following article is a dive into the world "Debt Snowball Tips," exploring the different types of printables, where they can be found, and how they can be used to enhance different aspects of your lives.

Get Latest Debt Snowball Tips Below

Debt Snowball Tips

Debt Snowball Tips -

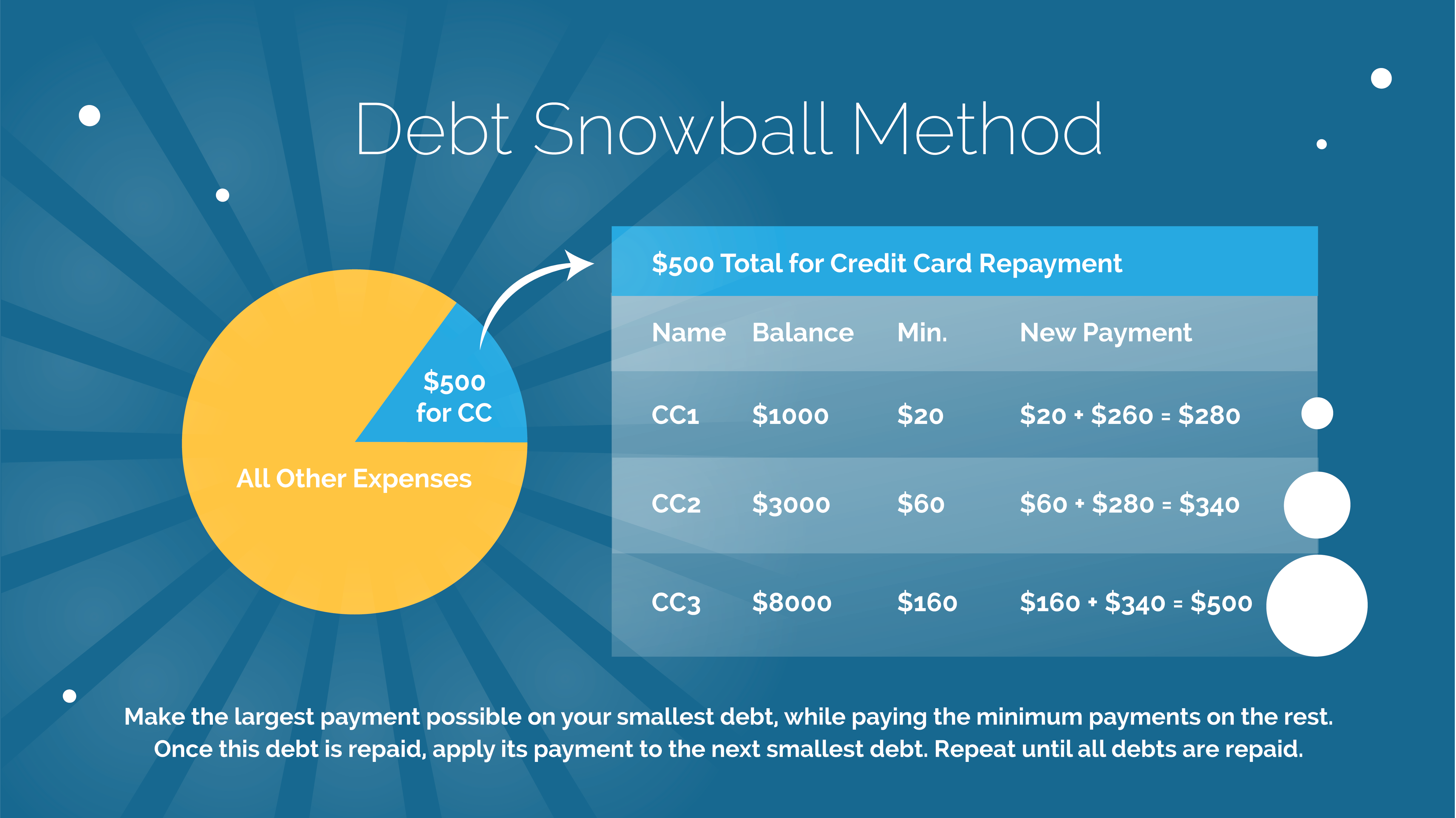

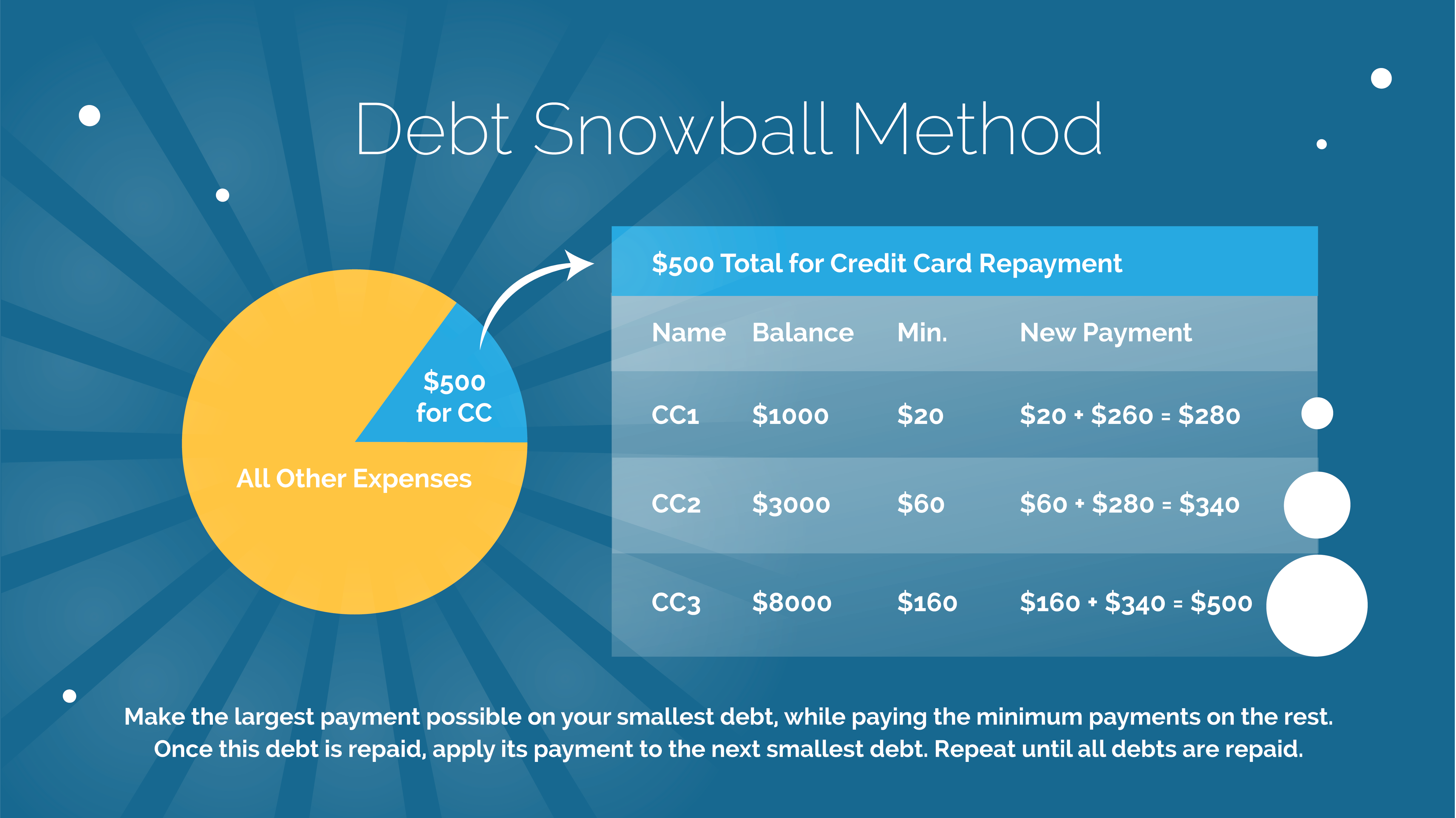

Step 1 List your debts from smallest to largest Step 2 Make minimum payments on all debts except the smallest throwing as much money as you can at that one Once that debt is gone take its payment and apply it to the next smallest debt while continuing to make minimum payments on your other debts

With the debt snowball method pay your smallest debt in full first then roll the amount that was going toward that bill into paying off your next biggest one The amount you re paying on your

The Debt Snowball Tips are a huge collection of printable resources available online for download at no cost. The resources are offered in a variety forms, including worksheets, coloring pages, templates and much more. The beauty of Debt Snowball Tips is their flexibility and accessibility.

More of Debt Snowball Tips

Does The Debt Snowball Method Really Work My Financial Hill Debt

Does The Debt Snowball Method Really Work My Financial Hill Debt

Follow the steps below to get started 1 Gather your bills To better understand your financial situation gather your debt related bills and highlight your monthly minimum payments and remaining balances These could be credit card bills medical bills student loans car loans and personal loans

The Debt Snowball Method Explained A Quick Start Guide Pay off your debt faster with the debt snowball method as popularized by Dave Ramsey Here s everything you need to know to get started today plus answers to some common questions like which saves you more a debt snowball or a debt avalanche R J Weiss CFP

Printables for free have gained immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

The ability to customize: It is possible to tailor printables to your specific needs, whether it's designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational Use: Free educational printables provide for students of all ages, which makes them a vital instrument for parents and teachers.

-

Convenience: Instant access to an array of designs and templates is time-saving and saves effort.

Where to Find more Debt Snowball Tips

The Debt Snowball Method A Complete Guide With Printables Debt

The Debt Snowball Method A Complete Guide With Printables Debt

With the debt snowball method you simply start with the smallest debt first and so you would order them accordingly 1st debt 1 000 50 minimum payment 2nd debt 2 000 65 minimum payment 3rd debt 3 000 70 minimum payment 4th debt 4 000 75 minimum payment For example let s say you have 1 000 to pay

Sam Bromley With the debt snowball method you reward yourself for wins along your debt payoff journey You pay your smallest debt in full first then roll the amount that was going toward

We've now piqued your curiosity about Debt Snowball Tips We'll take a look around to see where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection with Debt Snowball Tips for all motives.

- Explore categories like the home, decor, the arts, and more.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free Flashcards, worksheets, and other educational tools.

- The perfect resource for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers post their original designs and templates for no cost.

- The blogs are a vast range of interests, ranging from DIY projects to planning a party.

Maximizing Debt Snowball Tips

Here are some fresh ways ensure you get the very most use of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use printable worksheets for free to aid in learning at your home, or even in the classroom.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars or to-do lists. meal planners.

Conclusion

Debt Snowball Tips are a treasure trove of practical and innovative resources designed to meet a range of needs and interests. Their availability and versatility make them an invaluable addition to both personal and professional life. Explore the plethora that is Debt Snowball Tips today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Debt Snowball Tips truly absolutely free?

- Yes you can! You can print and download these tools for free.

-

Are there any free printing templates for commercial purposes?

- It's based on specific rules of usage. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Do you have any copyright issues in printables that are free?

- Some printables could have limitations regarding their use. Be sure to review the terms and regulations provided by the author.

-

How can I print Debt Snowball Tips?

- You can print them at home with either a printer at home or in any local print store for more high-quality prints.

-

What software will I need to access printables for free?

- Most printables come in PDF format, which can be opened using free software like Adobe Reader.

Debt snowball example Lauren Greutman

How I Paid Off 4000 In Debt Using The Snowball Method Debt Money On

Check more sample of Debt Snowball Tips below

Dave Ramsey Debt Snowball Tips For Large Debt Debt Snowball Dave

The Debt Snowball Method A Wise Trick For Debt Reduction Cashry

Free Printable Debt Snowball Worksheet Perhaps The Best Way To Pay

HELLO THERE Does It Look Impossible To Payoff Your Overall Debt I

How To Get Out Of Debt Debt Snowball Method Debt Rescue Blog

Account Suspended Personal Finance Budget Debt Snowball Debt

https://www.nerdwallet.com/article/finance/what-is-a-debt-snowball

With the debt snowball method pay your smallest debt in full first then roll the amount that was going toward that bill into paying off your next biggest one The amount you re paying on your

https://www.ramseysolutions.com/debt/how-the-debt...

Here s how the debt snowball works Step 1 List your debts from smallest to largest regardless of interest rate Step 2 Make minimum payments on all your debts except the smallest debt Step 3 Throw as much extra money as you can on your smallest debt until it s gone

With the debt snowball method pay your smallest debt in full first then roll the amount that was going toward that bill into paying off your next biggest one The amount you re paying on your

Here s how the debt snowball works Step 1 List your debts from smallest to largest regardless of interest rate Step 2 Make minimum payments on all your debts except the smallest debt Step 3 Throw as much extra money as you can on your smallest debt until it s gone

HELLO THERE Does It Look Impossible To Payoff Your Overall Debt I

The Debt Snowball Method A Wise Trick For Debt Reduction Cashry

How To Get Out Of Debt Debt Snowball Method Debt Rescue Blog

Account Suspended Personal Finance Budget Debt Snowball Debt

The Debt Snowball Method Broken Down Debt Snowball Dave Ramsey Debt

Pin On Debt Payoff

Pin On Debt Payoff

Debt Snowball Can Pay Off 6 000 In 6 Months Here s How Snowball